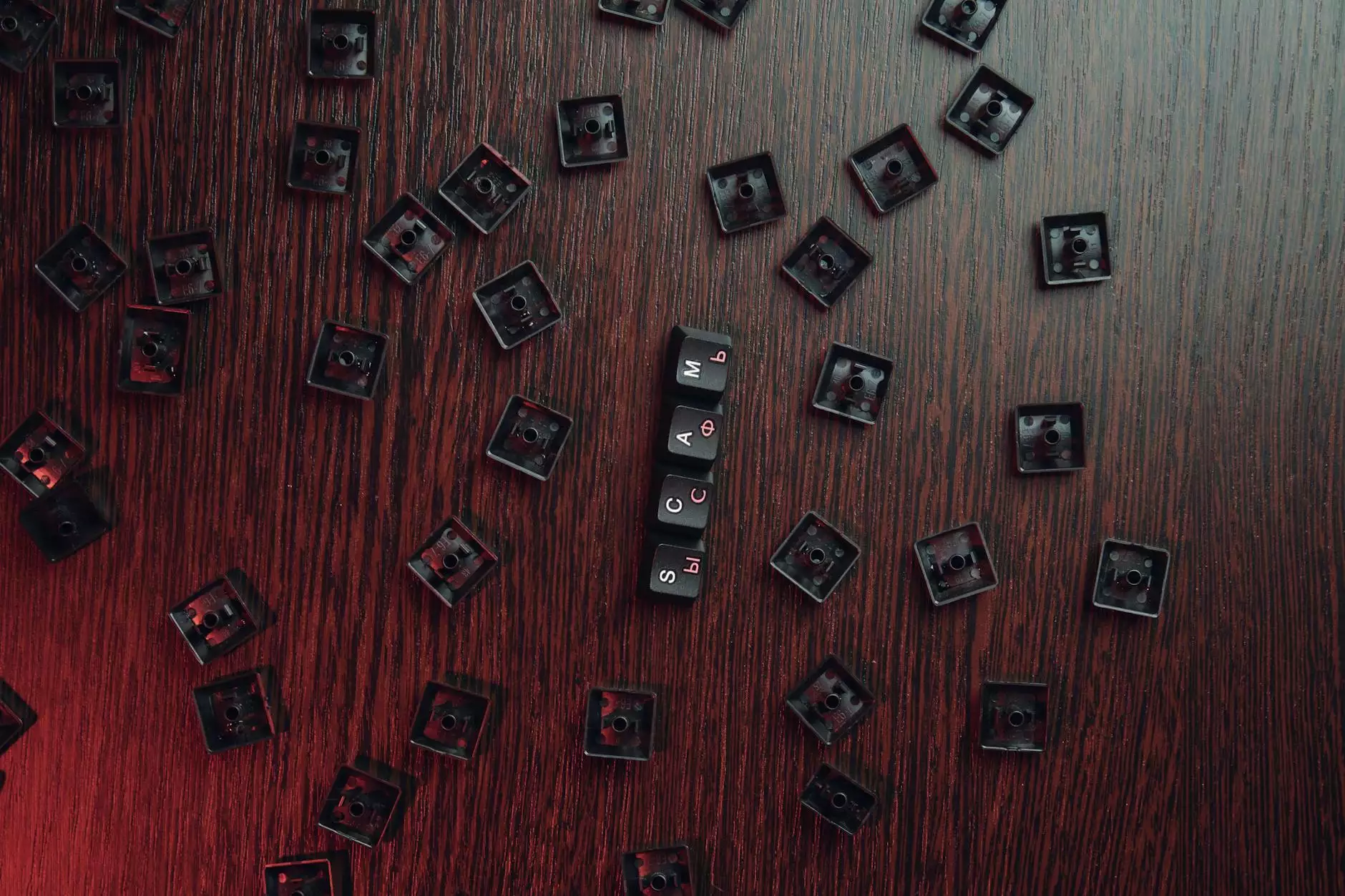

Understanding Business Success and Combating Internet Purchase Scam Fraud

In today's digital age, business growth and online commerce have become cornerstones of the global economy. However, with these opportunities come significant risks, particularly the threat of internet purchase scams. As consumers and entrepreneurs increasingly rely on online transactions, understanding how to identify fraudulent schemes, protect your investments, and maintain business integrity is more crucial than ever.

What Is an Internet Purchase Scam? A Deep Dive

An internet purchase scam involves deceptive online activities where malicious actors trick individuals or businesses into parting with their money under false pretenses. These scams have evolved in sophistication, often mimicking legitimate platforms, broker services, or product listings to lure unsuspecting victims.

- Types of internet purchase scams:

- Fake online stores that promise high-quality goods but never deliver

- Phony investment schemes disguised as broker services

- Phishing websites that steal sensitive financial information

- Advance-fee scams where payment is made upfront for nonexistent products

- Affiliate or reseller scams involving counterfeit products

Why Are Business Owners and Consumers Vulnerable?

Business owners and individual consumers are increasingly targeted due to the convenience and pseudosecurity that online platforms offer. Common vulnerabilities include:

- Lack of due diligence before engaging with new brokers or vendors

- Overreliance on online reviews without thorough verification

- Failure to recognize warning signs of scams, such as unrealistic promises or unprofessional website design

- Insufficient cybersecurity measures to prevent phishing or malware attacks

How to Recognize and Avoid Internet Purchase Scam

Prevention and vigilance are key to safeguarding your finances and reputation. Here are critical strategies for identifying and avoiding online purchase scams:

1. Verify Broker Listings and Reviews Thoroughly

Before engaging with any broker or online seller, conduct an extensive review of their credentials. Check for:

- Legitimate licensing or registration with financial authorities

- Verified customer reviews from independent sources

- Presence on reputable business review platforms like FraudComplaints.net

- Transparency in their terms of service and contact information

2. Scrutinize Website Security and Authenticity

Reliable websites invest in robust security measures. Look for:

- HTTPS protocol in the URL bar

- Professional, well-designed website content free of grammatical errors

- Clear refund, privacy, and data protection policies

- Visible physical addresses and customer service contacts

3. Be Wary of Unrealistic Promises and Pressure Tactics

Scammers often leverage high-pressure tactics, such as limited-time offers or exclusive deals, to rush decisions. Always:

- Request additional documentation or references

- Take your time to evaluate offers thoroughly

- Seek advice from trusted third-party review sites and forums

4. Use Secure Payment Methods

Avoid direct wire transfers, cryptocurrency, or untraceable payments. Instead, prefer methods that offer buyer protection, like credit cards or escrow services.

5. Regularly Monitor Financial Statements and Transactions

Stay vigilant by periodically reviewing your bank and credit card statements for suspicious activity. Report any irregularities immediately.

Role of Online Review Platforms in Detecting & Reporting Fraud

FraudComplaints.net plays an instrumental role in providing accurate and timely information about broker reviews, scam reports, and fraudulent activities. When you suspect or encounter a scam, documenting and sharing your experience helps warn others and enables regulatory actions.

- Broker reviews provide insights into verified user experiences, highlighting both legitimate and questionable brokers.

- Broker scam report sections allow victims to detail instances of fraud, aiding investigation efforts.

- Fraud complaints serve as a communal resource for businesses and consumers to collaborate and share awareness strategies.

The Consequences of Falling Victim to an Internet Purchase Scam

Beyond financial loss, victims can face devastating personal and professional repercussions, including:

- Loss of trust among clients and partners

- Damage to business reputation

- Legal complications if fraudulent activities involve legal infractions

- Emotional distress and financial hardship

How Business and Consumers Can Strengthen Their Defense

Education and preparedness are vital. Here are some comprehensive measures:

- Continuous Learning: Stay updated on the latest scam tactics and preventive techniques through trusted sources like FraudComplaints.net.

- Implement Strong Internal Policies: Businesses should establish strict vendor vetting procedures, clear transaction policies, and cybersecurity protocols.

- Regular Staff Training: Educate employees on recognizing phishing attempts, scam patterns, and secure transaction methods.

- Utilize Technology: Adopt anti-fraud software, secure payment gateways, and data encryption measures.

- Maintain Transparency: Ensure all dealings are transparent with proper documentation and accessible contact points.

Final Thoughts: Building a Resilient Business Environment

In the ongoing battle against internet purchase scam fraud, proactive engagement, robust verification processes, and leveraging trusted review platforms like FraudComplaints.net are essential. By fostering a culture of vigilance and transparency, businesses and consumers can not only protect themselves but also contribute to a safer online commerce ecosystem.

Summary of Key Takeaways

- Always verify broker credentials through authoritative and independent reviews.

- Regularly scrutinize websites for signs of security and legitimacy.

- Be cautious of offers that seem too good to be true or pressure tactics.

- Choose secure and traceable payment methods for online transactions.

- Maintain a proactive stance by educating staff and yourself about emerging scams.

- Report suspicious activities promptly on platforms like FraudComplaints.net.

In conclusion, understanding and actively managing the risks associated with online commerce is vital for sustainable business growth and personal financial security. By implementing rigorous verification protocols, staying informed, and utilizing community resources, you can significantly reduce the chances of falling prey to an internet purchase scam.

Remember, a well-informed and vigilant approach is your best defense in the digital marketplace.